Introduction: Navigating the Global Market for plastic bottle numbers to avoid

In today’s global marketplace, sourcing the right plastic bottles is a critical challenge for B2B buyers, particularly when it comes to understanding which plastic bottle numbers to avoid. With increasing concerns about health and environmental impacts, businesses must navigate a complex landscape of materials while ensuring compliance with regional regulations and consumer safety standards. This guide offers a comprehensive exploration of plastic bottle types, their applications, and the implications of the numbers stamped on them, enabling buyers to make informed decisions.

Throughout this resource, we delve into the various types of plastics, detailing their uses in industries ranging from food and beverage to pharmaceuticals. We also emphasize the importance of supplier vetting to ensure that your sourcing partners adhere to safety and sustainability practices. Additionally, we provide insights into cost considerations, helping you balance budget constraints with the necessity for quality materials.

By equipping international B2B buyers from regions such as Africa, South America, the Middle East, and Europe—including key markets like Germany and Nigeria—with actionable insights, this guide empowers you to mitigate risks associated with plastic products. Whether you’re looking to enhance your supply chain or improve product safety, understanding which plastic bottle numbers to avoid is a vital step in fostering a responsible and successful purchasing strategy.

Article Navigation

- Top 6 Plastic Bottle Numbers To Avoid Manufacturers & Suppliers List

- Introduction: Navigating the Global Market for plastic bottle numbers to avoid

- Understanding plastic bottle numbers to avoid Types and Variations

- Key Industrial Applications of plastic bottle numbers to avoid

- 3 Common User Pain Points for ‘plastic bottle numbers to avoid’ & Their Solutions

- Strategic Material Selection Guide for plastic bottle numbers to avoid

- In-depth Look: Manufacturing Processes and Quality Assurance for plastic bottle numbers to avoid

- Practical Sourcing Guide: A Step-by-Step Checklist for ‘plastic bottle numbers to avoid’

- Comprehensive Cost and Pricing Analysis for plastic bottle numbers to avoid Sourcing

- Alternatives Analysis: Comparing plastic bottle numbers to avoid With Other Solutions

- Essential Technical Properties and Trade Terminology for plastic bottle numbers to avoid

- Navigating Market Dynamics and Sourcing Trends in the plastic bottle numbers to avoid Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of plastic bottle numbers to avoid

- Important Disclaimer & Terms of Use

- Strategic Sourcing Conclusion and Outlook for plastic bottle numbers to avoid

Understanding plastic bottle numbers to avoid Types and Variations

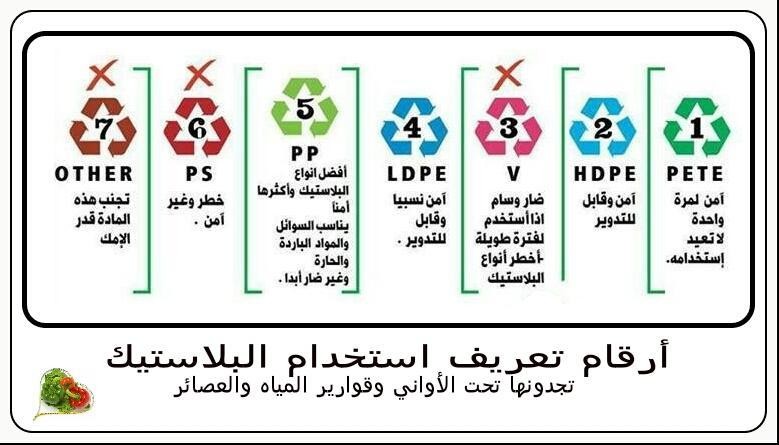

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Polyvinyl Chloride (PVC) – #3 | Flexible, often clear; used in cling wraps and piping | Food packaging, construction materials | Pros: Low cost; versatile. Cons: Potentially harmful chemicals; not ideal for food contact. |

| Polystyrene (PS) – #6 | Rigid, often foam-based; used in disposable products | Food service (takeout containers), insulation | Pros: Lightweight; inexpensive. Cons: Non-recyclable; leaches harmful chemicals. |

| Mixed Plastics – #7 | Includes various plastics; often contains BPA | Electronics, packaging for diverse products | Pros: Wide range of applications. Cons: Unpredictable chemical composition; often toxic. |

| Low-Density Polyethylene (LDPE) – #4 | Soft, flexible; used in bags and wraps | Grocery bags, food packaging | Pros: Lightweight; relatively safe. Cons: Not widely recyclable; less durable. |

| Polypropylene (PP) – #5 | Stiff, heat resistant; used in food containers | Food storage, automotive parts | Pros: Safe for food; recyclable. Cons: May require specific recycling processes; less flexible than other types. |

What Are the Key Characteristics of Polyvinyl Chloride (PVC) Bottles?

Polyvinyl Chloride, denoted as #3, is a widely used plastic known for its versatility and flexibility. However, its use in food-related applications is concerning due to the potential leaching of harmful chemicals during manufacturing and disposal. B2B buyers should consider the long-term implications of using PVC in food packaging, as it may pose health risks to consumers, leading to negative brand perception.

Why Are Polystyrene (PS) Bottles Considered a Poor Choice?

Polystyrene, marked as #6, is often found in disposable cutlery and food containers. While it is lightweight and cost-effective, it poses significant environmental and health risks. PS is non-recyclable and can leach styrene, a chemical linked to various health issues. B2B buyers in the food service industry should seek alternatives to polystyrene to align with sustainability goals and ensure consumer safety.

What Should Buyers Know About Mixed Plastics (#7)?

Mixed plastics encompass a variety of materials and often include components like Bisphenol A (BPA), which raises health concerns. The unpredictability of this category makes it difficult for B2B buyers to assess safety. Companies should avoid using #7 plastics for food-related products and instead opt for clearer labeling and safer alternatives to maintain consumer trust and regulatory compliance.

How Does Low-Density Polyethylene (LDPE) Measure Up?

Low-Density Polyethylene, labeled as #4, is commonly used for grocery bags and food wraps. While it is considered relatively safe, it is not widely recyclable, which can lead to environmental issues. B2B buyers should weigh the benefits of using LDPE against its disposal challenges, especially in regions with limited recycling infrastructure.

Why Is Polypropylene (#5) a Safer Option for B2B Applications?

Polypropylene is recognized as #5 and is known for its rigidity and heat resistance. It is safe for food storage and can be recycled, making it a favorable choice for B2B applications in food packaging and storage solutions. However, buyers must ensure that they have access to appropriate recycling facilities to maximize sustainability efforts.

Key Industrial Applications of plastic bottle numbers to avoid

| Industry/Sector | Specific Application of plastic bottle numbers to avoid | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Food and Beverage | Use of PVC (#3) in food packaging | Reduces health risks and enhances consumer trust | Ensure compliance with local food safety regulations and standards. |

| Pharmaceuticals | Storage of medicines in polystyrene (#6) containers | Protects product integrity and minimizes contamination risks | Source from certified suppliers that adhere to stringent quality controls. |

| Environmental Services | Recycling of mixed plastics (#7) | Supports sustainability efforts and reduces environmental impact | Partner with recycling companies that can handle various plastic types. |

| Retail and E-commerce | Avoiding low-density polyethylene (#4) for product packaging | Improves product safety and enhances brand reputation | Seek suppliers that provide eco-friendly alternatives to LDPE. |

| Consumer Goods | Use of polyvinyl chloride (#3) for non-food items | Reduces liability and potential health claims | Verify that suppliers follow best practices in material safety. |

How Can Businesses in the Food and Beverage Industry Benefit from Avoiding PVC (#3)?

In the food and beverage industry, the use of PVC (#3) in packaging can pose significant health risks due to harmful chemicals leaching into food products. By avoiding PVC, businesses enhance consumer trust and comply with safety regulations. This shift not only safeguards public health but also aligns with growing consumer demand for safer, healthier food options. International buyers, especially in regions like Africa and South America, should prioritize suppliers who provide alternative materials that meet stringent food safety standards.

Why Should Pharmaceutical Companies Avoid Polystyrene (#6) for Medicine Storage?

Pharmaceutical companies often face challenges with product integrity and contamination risks when using polystyrene (#6) containers. This plastic can leach harmful chemicals, compromising the safety and efficacy of medications. By sourcing safer materials, businesses can protect their products and reputation. Buyers in the Middle East and Europe should focus on suppliers that guarantee high-quality, compliant packaging materials, ensuring that they meet the industry’s rigorous standards for safety and efficacy.

What Are the Environmental Benefits of Avoiding Mixed Plastics (#7)?

Environmental services can significantly benefit from avoiding mixed plastics (#7) in their recycling operations. These plastics often contain various materials, making them challenging to recycle and increasing the risk of contamination. By focusing on cleaner, more manageable plastics, companies can enhance their sustainability efforts and reduce their environmental footprint. B2B buyers should consider partnering with specialized recycling firms that have the capacity to process specific types of plastics effectively, contributing to a circular economy.

How Can Retailers Improve Safety by Avoiding Low-Density Polyethylene (#4)?

Retail and e-commerce businesses can enhance product safety and brand reputation by avoiding low-density polyethylene (#4) in their packaging. Although LDPE is relatively safe, it is not recyclable, which can lead to environmental issues. By opting for recyclable or biodegradable alternatives, retailers can meet consumer demand for sustainable practices. International buyers should seek suppliers that prioritize eco-friendly packaging solutions, particularly in regions where environmental regulations are becoming increasingly stringent.

What Are the Risks of Using Polyvinyl Chloride (#3) in Consumer Goods?

Consumer goods manufacturers should be cautious about using polyvinyl chloride (#3) in non-food items due to potential health risks associated with chemical leaching. This can lead to liability issues and negative consumer perceptions. By avoiding PVC and opting for safer alternatives, businesses can mitigate these risks and enhance their product offerings. Buyers, particularly in Europe and Africa, should prioritize suppliers who provide transparent information about material safety and compliance with health regulations.

3 Common User Pain Points for ‘plastic bottle numbers to avoid’ & Their Solutions

Scenario 1: Confusion Over Plastic Bottle Safety Standards

The Problem: B2B buyers, especially those in the food and beverage industry, often struggle to navigate the complex landscape of plastic safety standards. With various plastics labeled from 1 to 7, determining which ones are safe for food contact can be overwhelming. This confusion can lead to the inadvertent purchase of unsafe containers, risking product contamination and potential health issues for consumers. For example, a buyer may mistakenly order plastic bottles labeled with the number 3 (PVC), which are not recommended for food use, instead of safer options like those labeled 1 (PET) or 2 (HDPE).

The Solution: To effectively mitigate this confusion, B2B buyers should establish a clear sourcing protocol that prioritizes materials with established safety standards. Begin by creating a checklist of acceptable plastic types based on their numbers. Train procurement teams to recognize these numbers, focusing on those that are deemed safe for food storage: 1, 2, 4, and 5. Additionally, consider sourcing from suppliers who provide comprehensive product specifications, including safety certifications. This proactive approach ensures that all purchased containers meet safety guidelines and reduces the risk of costly recalls or health issues down the line.

Scenario 2: Environmental Concerns Regarding Plastic Waste

The Problem: Many B2B buyers are increasingly aware of the environmental impact of plastics, especially in regions like Europe and South America where sustainability is a growing concern. Buyers may find themselves in a dilemma when choosing between cost-effective plastic options and environmentally friendly alternatives. For instance, while plastics labeled with numbers 1 and 2 are recyclable, plastics 6 (PS) and 7 (mixed) pose significant recycling challenges, leading to environmental harm and negative public perception if used for packaging.

The Solution: To address these environmental concerns, B2B buyers should prioritize partnerships with manufacturers who specialize in sustainable materials. Actively seek suppliers who offer biodegradable or recyclable options and are transparent about their recycling processes. Implementing a policy that mandates the use of recyclable plastics (1, 2, 4, and 5) can also help minimize waste. Furthermore, consider integrating a take-back program for used plastic bottles, encouraging recycling and reinforcing a commitment to environmental responsibility. This not only enhances brand reputation but can also lead to cost savings in waste management.

Scenario 3: Regulatory Compliance and Liability Risks

The Problem: In many markets, compliance with health and safety regulations regarding packaging materials is critical. B2B buyers in industries such as food service and retail face the challenge of ensuring that their products comply with local and international regulations regarding food safety. Using plastics that are not compliant, such as those labeled 3 (PVC) or 6 (PS), can lead to legal liabilities, product recalls, and damage to brand reputation. This scenario is particularly concerning for businesses operating in regions with strict regulatory frameworks, like Germany.

The Solution: To navigate these regulatory landscapes effectively, B2B buyers should engage legal and compliance experts to understand the specific requirements in their regions. Establishing a compliance checklist that includes acceptable plastic types is essential. Regular audits of suppliers and their materials can help ensure that all packaging meets necessary regulations. Additionally, maintain open communication with suppliers about their compliance status and any changes in regulations. This proactive strategy not only helps mitigate liability risks but also fosters trust with consumers who are increasingly concerned about product safety.

Strategic Material Selection Guide for plastic bottle numbers to avoid

What Plastics Should B2B Buyers Avoid for Bottles?

In the realm of plastic bottle manufacturing, understanding the implications of material selection is crucial for international B2B buyers. Certain plastics, particularly those labeled with specific numbers, pose health risks and environmental concerns. This analysis focuses on the properties, advantages, disadvantages, and specific considerations for four plastic types that should be avoided in bottle production.

Why Should B2B Buyers Avoid PVC (Polyvinyl Chloride)?

PVC, marked as number 3, is commonly used in various applications, including food packaging and plumbing materials. However, its key properties include low-temperature resistance and moderate mechanical strength. While it is cost-effective and widely available, the production and disposal of PVC release harmful chemicals, such as dioxins, which can have serious health implications. For B2B buyers, especially in regions like Africa and the Middle East, compliance with environmental regulations is critical. Many countries are moving towards banning or restricting PVC usage, making it a risky choice for long-term investments.

What Are the Risks of Using Polystyrene (PS)?

Polystyrene, identified by the number 6, is often found in disposable cutlery and food containers. It offers good insulation properties and is lightweight, making it an attractive option for manufacturers. However, its major drawback is that it can leach harmful chemicals like styrene into food and beverages, posing health risks. Additionally, PS is not recyclable and contributes significantly to environmental pollution. B2B buyers in Europe, particularly in Germany, should be aware of stringent regulations against single-use plastics, which may affect the marketability of products made from polystyrene.

How Does Mixed Plastic (Number 7) Affect Product Safety?

Mixed plastics, denoted by number 7, encompass a wide range of materials, including those containing BPA. These plastics can exhibit varying properties depending on their composition, leading to unpredictable performance. While they may be used for a variety of applications, their safety around food is questionable due to potential chemical leaching. For international buyers, especially in South America and Africa, the lack of standardized regulations regarding mixed plastics can complicate compliance and safety assurances. This uncertainty can deter customers, impacting sales and brand reputation.

Why Is It Important to Avoid Low-Density Polyethylene (LDPE) for Food Packaging?

LDPE, labeled as number 4, is commonly used for grocery bags and food wraps. Although it is considered relatively safe, it has limited recyclability and can degrade over time, compromising product integrity. Its low strength and flexibility make it less suitable for applications requiring durability. For B2B buyers, particularly in regions with developing recycling infrastructures, such as Nigeria, the challenge of managing LDPE waste can pose significant operational hurdles. Additionally, as global standards evolve, reliance on LDPE may conflict with emerging sustainability goals.

Summary Table of Plastics to Avoid

| Material | Typical Use Case for plastic bottle numbers to avoid | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| PVC (Polyvinyl Chloride) | Food packaging, plumbing materials | Cost-effective, widely available | Releases harmful chemicals; health risks | Low |

| Polystyrene (PS) | Disposable cutlery, food containers | Good insulation properties, lightweight | Leaches harmful chemicals; non-recyclable | Low |

| Mixed Plastic (Number 7) | Various applications, including baby bottles | Versatile, used in many products | Unpredictable safety; potential leaching of BPA | Medium |

| Low-Density Polyethylene (LDPE) | Grocery bags, food wraps | Relatively safe for food contact | Limited recyclability; low durability | Low |

By understanding the implications of these materials, B2B buyers can make informed decisions that align with health standards, regulatory compliance, and sustainability goals.

In-depth Look: Manufacturing Processes and Quality Assurance for plastic bottle numbers to avoid

When considering the manufacturing processes and quality assurance for plastic bottles, particularly those with numbers that indicate potential health risks, B2B buyers must navigate a complex landscape. Understanding the manufacturing stages, quality control mechanisms, and international standards can help in making informed decisions when sourcing products.

What Are the Main Stages in the Manufacturing Process of Plastic Bottles?

The manufacturing of plastic bottles involves several key stages, each with its unique techniques and quality checkpoints.

Material Preparation: How Are Raw Materials Processed?

The first stage involves sourcing and preparing the raw materials, primarily various types of plastics such as PET, HDPE, PVC, and others. For safer options, plastics labeled with numbers 1, 2, 4, and 5 are generally preferred. The raw materials are often in the form of pellets that must be dried and melted before processing.

- Key Techniques:

- Pelletizing: Converting plastic resin into small pellets for easier handling.

- Drying: Removing moisture from the pellets to prevent defects during molding.

Forming: What Techniques Are Used to Shape Plastic Bottles?

Once the materials are prepared, the next step is forming the bottles. This is typically achieved through methods such as blow molding, injection molding, or extrusion molding.

- Blow Molding: This is the most common method for producing hollow plastic bottles. It involves heating the plastic until it is malleable, then inflating it into a mold to achieve the desired shape.

- Injection Molding: This method is often used for caps and lids. Plastic is injected into a mold, cooled, and then ejected.

- Extrusion Molding: This technique is useful for creating tubes or continuous shapes and is sometimes used for bottle preforms.

Assembly: How Are Different Components Put Together?

In the assembly stage, various components such as caps and labels are attached to the bottles. This may involve manual labor or automated systems, depending on the scale of production.

- Key Techniques:

- Automated Assembly Lines: Streamlining the process for high-volume production.

- Quality Checks: Conducting in-line inspections to ensure that each component fits correctly and meets design specifications.

Finishing: What Final Touches Are Added to the Bottles?

The finishing stage involves final touches such as printing, labeling, and surface treatment. This not only enhances the aesthetic appeal but also ensures compliance with regulatory standards.

- Key Techniques:

- Printing: Using digital or pad printing to apply labels or branding directly onto the bottle.

- Surface Treatment: Applying coatings that can enhance durability or improve recyclability.

What Are the Quality Control (QC) Mechanisms in Plastic Bottle Manufacturing?

Quality control is critical to ensuring that the plastic bottles produced meet safety and regulatory standards.

What International Standards Should B2B Buyers Consider?

B2B buyers must be familiar with various international standards that govern the quality of plastic products. Commonly referenced standards include:

- ISO 9001: This standard outlines the requirements for a quality management system, ensuring that organizations meet customer and regulatory requirements consistently.

- CE Marking: A certification that indicates conformity with health, safety, and environmental protection standards for products sold within the European Economic Area.

- API Standards: For bottles used in pharmaceuticals, API (American Petroleum Institute) standards may apply.

What QC Checkpoints Should Be Established?

Quality control should occur at various checkpoints throughout the manufacturing process:

- Incoming Quality Control (IQC): Inspecting raw materials upon arrival to ensure they meet specified standards.

- In-Process Quality Control (IPQC): Continuous monitoring during the manufacturing process, including checks at each production stage to identify and rectify defects early.

- Final Quality Control (FQC): Conducting thorough inspections of the finished product before packaging and shipping.

What Common Testing Methods Are Used?

B2B buyers should be aware of the various testing methods that manufacturers may employ to ensure product safety and quality:

- Mechanical Testing: Assessing the strength and durability of the plastic under different conditions.

- Chemical Analysis: Testing for harmful substances such as BPA in plastics marked with numbers 3, 6, and 7.

- Thermal Testing: Evaluating how the plastic reacts to heat, which is critical for products intended for food storage.

How Can B2B Buyers Verify Supplier QC Practices?

Ensuring that suppliers adhere to strict quality control measures is vital for B2B buyers. Here are some methods for verification:

- Supplier Audits: Conducting on-site audits to assess manufacturing processes, QC checkpoints, and compliance with international standards.

- Quality Assurance Reports: Requesting documentation that outlines the QC processes employed by the supplier, including testing results and compliance certifications.

- Third-Party Inspections: Engaging independent inspectors to evaluate the manufacturing processes and product quality before shipment.

What Are the QC Nuances for International B2B Buyers?

International buyers, particularly those from regions such as Africa, South America, the Middle East, and Europe, must consider additional factors:

- Cultural and Regulatory Differences: Understanding local regulations concerning plastic use and recycling is crucial for compliance.

- Logistical Considerations: Shipping and handling processes may differ by region, affecting product quality upon arrival.

- Sustainability Practices: Increasingly, buyers are looking for suppliers who implement sustainable practices in both manufacturing and packaging.

By understanding the intricacies of the manufacturing process and implementing rigorous quality control practices, B2B buyers can make informed decisions that prioritize safety, compliance, and sustainability in their sourcing strategies.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘plastic bottle numbers to avoid’

Introduction

Navigating the complexities of plastic sourcing can be challenging, particularly when it comes to identifying the types of plastic that pose health risks. This guide provides B2B buyers with a practical checklist to help avoid purchasing plastic bottles made from harmful materials. By following these steps, you can ensure compliance with health standards and protect your brand’s reputation.

Step 1: Identify Plastic Numbers to Avoid

Begin by familiarizing yourself with the plastic identification numbers. Specifically, avoid plastics labeled with numbers 3 (PVC), 6 (PS), and 7 (mixed). These plastics are linked to various health risks, including hormonal disruptions and potential carcinogenic effects. Knowing these numbers is vital for making informed purchasing decisions.

Step 2: Assess Supplier Materials

When sourcing plastic bottles, inquire about the specific materials used by suppliers. Ensure they can provide detailed information on the plastic types and their corresponding numbers. This transparency is crucial, as it allows you to verify that the products align with your health and safety standards.

Step 3: Request Material Safety Data Sheets (MSDS)

Always ask suppliers for Material Safety Data Sheets related to the plastics they use. These documents outline potential hazards associated with the materials, including health risks and proper handling procedures. Having access to MSDS ensures that you are informed about any potential dangers associated with the products you are considering.

Step 4: Evaluate Recycling Practices

Check if the supplier has a robust recycling program for their plastic products. Ideally, the plastics you procure should be recyclable and sourced from suppliers who prioritize sustainability. This not only aligns with global environmental standards but also enhances your company’s commitment to responsible sourcing.

Step 5: Verify Certifications and Compliance

Ensure that your suppliers hold relevant certifications for their products, such as ISO or FDA approvals. These certifications indicate that the materials have been tested for safety and comply with international health standards. This step is essential in mitigating risks associated with harmful substances in plastics.

Step 6: Conduct Supplier Audits

Regularly audit your suppliers to assess their adherence to safety and quality standards. This involves on-site visits or third-party assessments that can reveal critical insights about the supplier’s operations. Auditing is a proactive approach to ensure that suppliers maintain compliance with the necessary regulations and practices.

Step 7: Educate Your Team on Plastic Safety

Finally, ensure that your procurement team is well-versed in the implications of plastic sourcing. Providing training on identifying safe versus unsafe plastics, understanding health impacts, and recognizing labeling can empower your team to make better purchasing decisions. Knowledge is a powerful tool in fostering a responsible sourcing culture within your organization.

By following this checklist, you can effectively navigate the complexities of sourcing plastic bottles while prioritizing health and safety for both consumers and your business.

Comprehensive Cost and Pricing Analysis for plastic bottle numbers to avoid Sourcing

What Are the Key Cost Components in Sourcing Plastic Bottles to Avoid?

When sourcing plastic bottles, especially those marked with numbers to avoid (3, 6, and 7), understanding the cost structure is crucial for B2B buyers. The primary cost components include:

-

Materials: The type of plastic significantly affects costs. For instance, polyvinyl chloride (PVC), used in number 3 plastics, is typically cheaper than alternatives like polyethylene terephthalate (PET), which is more favored for safety. However, sourcing materials that comply with health regulations may incur higher costs.

-

Labor: Labor costs vary depending on the manufacturing location. Countries with lower labor costs may provide a competitive edge, but the quality of labor and adherence to safety regulations should not be compromised.

-

Manufacturing Overhead: This includes costs related to machinery, energy consumption, and facility maintenance. Efficient manufacturing processes can help reduce overhead and ultimately lower pricing for buyers.

-

Tooling: Custom molds for specific bottle designs can be a significant upfront investment. Buyers should consider whether the tooling costs will be amortized over a large volume of orders, thus reducing per-unit costs.

-

Quality Control (QC): Ensuring that plastic bottles meet safety standards and regulations requires robust QC processes. This can add to costs but is essential for avoiding liabilities associated with health risks.

-

Logistics: Shipping costs depend on the distance, volume, and mode of transport. For international buyers, understanding Incoterms can help clarify responsibilities and costs associated with shipping.

-

Margin: Suppliers will add a margin to cover their costs and generate profit. This margin can vary widely based on supplier reputation, product quality, and market demand.

How Do Price Influencers Impact the Cost of Plastic Bottles?

Several factors influence the pricing of plastic bottles, particularly those that are deemed unsafe:

-

Volume/MOQ: Larger orders typically yield better pricing due to economies of scale. Buyers should assess their needs to negotiate favorable minimum order quantities (MOQs).

-

Specifications/Customization: Customized bottles require additional tooling and may incur higher costs. Buyers should evaluate whether standard designs can meet their needs to minimize expenses.

-

Materials: The choice between safe and unsafe plastics can impact cost. Materials that are safer but more expensive may be necessary, especially for food-related applications.

-

Quality/Certifications: Bottles that meet specific health and safety standards will generally be priced higher. Certifications may be essential for compliance in certain markets, particularly in Europe.

-

Supplier Factors: The reputation and reliability of suppliers can affect pricing. Established suppliers may charge premium prices, but they often provide better quality assurance and service.

-

Incoterms: Understanding the implications of Incoterms can help buyers manage costs effectively. For example, choosing “CIF” (Cost, Insurance, and Freight) can shift some risk and cost to the supplier, potentially simplifying budgeting.

What Buyer Tips Can Help in Sourcing Plastic Bottles?

-

Negotiation: Engage suppliers in discussions about pricing and be prepared to leverage volume commitments for better rates. Establishing long-term relationships can also lead to favorable terms.

-

Cost-Efficiency: Analyze the Total Cost of Ownership (TCO), which includes acquisition costs, operational expenses, and potential liabilities. This holistic view can help in making informed sourcing decisions.

-

Pricing Nuances for International Buyers: International buyers should be aware of currency fluctuations, tariffs, and trade regulations that can impact overall costs. Utilizing local suppliers may mitigate some of these risks.

-

Disclaimer on Indicative Prices: It’s important for buyers to understand that prices can fluctuate based on market conditions, material availability, and geopolitical factors. Always seek updated quotes to ensure accurate budgeting.

By understanding these components and factors, B2B buyers can navigate the complexities of sourcing plastic bottles and make informed purchasing decisions that align with their business goals and regulatory requirements.

Alternatives Analysis: Comparing plastic bottle numbers to avoid With Other Solutions

Exploring Alternatives to Plastic Bottle Numbers to Avoid

As global awareness of the health and environmental impacts of certain plastics increases, businesses must consider alternatives to using plastics, especially those labeled with numbers that indicate potential hazards. This section delves into viable alternatives to the less desirable plastic types, providing B2B buyers with insights on how to make informed decisions that align with sustainability and safety goals.

| Comparison Aspect | Plastic Bottle Numbers To Avoid | Alternative 1 Name | Alternative 2 Name |

|---|---|---|---|

| Performance | Limited safety for food use; potential leaching of harmful chemicals | Glass Bottles | Stainless Steel Bottles |

| Cost | Generally low initial cost but higher long-term health risks | Moderate initial investment but longevity reduces overall costs | Higher initial cost but durable and reusable |

| Ease of Implementation | Easy to find but requires careful selection and education on labeling | Widely available; requires careful handling | Requires training for staff on care and use |

| Maintenance | Low maintenance; but risk of degradation over time | Requires careful handling to avoid breakage | Easy to clean; resistant to wear and tear |

| Best Use Case | Short-term use in low-risk environments | Ideal for beverages and food storage | Best for outdoor and active environments |

In-Depth Look at Alternatives

Glass Bottles

Glass bottles are a popular alternative to harmful plastic types. They do not leach chemicals and are recyclable. The main advantage of glass is its inert nature, making it safe for food and beverages. However, they can be more expensive initially and pose a risk of breakage, which may require careful handling and additional training for employees. Businesses focusing on sustainability and health will find glass a suitable option, especially in premium markets.

Stainless Steel Bottles

Stainless steel bottles present another robust alternative, offering excellent durability and insulation properties. Unlike plastic, they do not leach harmful chemicals and can maintain the temperature of beverages for extended periods. Although the upfront cost is higher, their longevity and resistance to wear make them a cost-effective solution in the long run. The challenge lies in ensuring proper cleaning and maintenance, which may necessitate staff training. Stainless steel is particularly beneficial for businesses in active sectors, like outdoor events or sports, where durability is paramount.

Conclusion: Choosing the Right Solution for Your Business Needs

When selecting an alternative to plastic bottles, B2B buyers must evaluate their specific needs regarding performance, cost, and practicality. Glass bottles are ideal for businesses prioritizing health and environmental sustainability, while stainless steel bottles cater to those needing durability and long-term cost savings. By understanding the strengths and weaknesses of each option, companies can make informed decisions that not only align with health standards but also promote a sustainable business model.

Essential Technical Properties and Trade Terminology for plastic bottle numbers to avoid

What Are the Key Technical Properties to Consider When Avoiding Unsafe Plastic Bottles?

When navigating the complex landscape of plastic bottles, it is crucial to understand specific technical properties that can impact both health and sustainability. Here are some of the most critical specifications to consider:

1. Material Grade

Material grade refers to the quality and type of plastic used in manufacturing bottles. Different grades, such as Polyethylene Terephthalate (PET) or Polypropylene (PP), have distinct safety profiles and recyclability. For B2B buyers, selecting the right material grade is essential not only for compliance with health regulations but also for ensuring consumer safety and brand integrity.

2. Tolerance Levels

Tolerance levels indicate the permissible variations in dimensions and weight during the manufacturing process. In the context of plastic bottles, tight tolerances can enhance the functionality and safety of the product. For instance, a bottle with precise tolerances will be less likely to leak or break under pressure, which is vital for preserving the contents and maintaining brand reputation.

3. Recyclability

Recyclability assesses whether a plastic bottle can be effectively processed into new products after its lifecycle. This property is particularly important for businesses aiming to promote sustainability and reduce environmental impact. Understanding the recycling capabilities of various plastic types helps companies align with eco-friendly practices and meet consumer demand for sustainable products.

4. Chemical Resistance

Chemical resistance is a property that defines how well a plastic material can withstand exposure to various chemicals without degrading. For B2B buyers, selecting bottles with high chemical resistance is crucial when packaging products that may react adversely with certain materials, ensuring product safety and integrity.

5. Temperature Tolerance

Temperature tolerance indicates the range of temperatures a plastic bottle can withstand without losing structural integrity. This property is vital for products that require heating or refrigeration. Understanding temperature tolerance helps businesses ensure that their packaging solutions are suitable for specific applications, thus avoiding potential product failures.

What Are Common Trade Terms Related to Plastic Bottles?

Understanding industry jargon can significantly enhance communication and negotiation processes. Here are some essential terms that B2B buyers should be familiar with:

1. OEM (Original Equipment Manufacturer)

OEM refers to a company that produces parts or equipment that may be marketed by another manufacturer. In the context of plastic bottles, B2B buyers often work with OEMs to create customized packaging solutions tailored to their specific needs.

2. MOQ (Minimum Order Quantity)

MOQ is the minimum number of units a supplier is willing to sell. This term is crucial for buyers to understand as it can affect budgeting and inventory management. Knowing the MOQ allows businesses to plan their purchases strategically, avoiding excess costs or stock shortages.

3. RFQ (Request for Quotation)

An RFQ is a document sent by a buyer to suppliers requesting pricing and terms for a specific quantity of goods or services. In the plastic bottle industry, submitting an RFQ helps buyers gauge market prices and compare different suppliers, leading to informed purchasing decisions.

4. Incoterms (International Commercial Terms)

Incoterms are a set of predefined commercial terms published by the International Chamber of Commerce (ICC). These terms clarify the responsibilities of buyers and sellers in international transactions, including the delivery of goods and payment obligations. Understanding Incoterms is vital for B2B buyers engaged in global sourcing of plastic bottles, as it minimizes risks associated with shipping and logistics.

5. Compliance Standards

Compliance standards refer to regulations that products must meet to ensure safety and quality. In the plastic bottle industry, understanding compliance standards, such as those set by the FDA or EU regulations, is crucial for B2B buyers to ensure that their products are safe for consumer use and meet legal requirements.

By grasping these technical properties and trade terms, B2B buyers can make informed decisions when sourcing plastic bottles, ensuring safety, compliance, and sustainability in their product offerings.

Navigating Market Dynamics and Sourcing Trends in the plastic bottle numbers to avoid Sector

What Are the Global Drivers Influencing the Plastic Bottle Market?

The global plastic bottle market is shaped by various dynamics, including consumer awareness of health risks associated with certain plastics, increasing regulations, and the demand for sustainable packaging solutions. In regions such as Africa and South America, rapid urbanization and population growth drive the need for affordable and accessible bottled products, but consumers are increasingly aware of the implications of using certain plastic types. In contrast, European markets, particularly in Germany, are pushing for stringent regulations on plastic use, emphasizing the need for B2B buyers to navigate the complexities of compliance and sustainability.

Emerging technologies are also transforming sourcing trends. Innovations in recycling processes and the development of biodegradable alternatives are becoming key focal points for manufacturers. B2B buyers are encouraged to seek suppliers who leverage advanced technologies for producing safer plastics, particularly those labeled with numbers 1, 2, 4, and 5, which are recognized as safer for food contact. Additionally, the rise of e-commerce and digital platforms is facilitating better access to information about plastic types, enabling buyers to make informed decisions.

How Is Sustainability Shaping B2B Sourcing Decisions in the Plastic Bottle Sector?

The environmental impact of plastic waste is a significant concern, compelling B2B buyers to prioritize ethical sourcing and sustainability in their procurement strategies. The shift towards a circular economy is becoming essential, with companies seeking suppliers who can demonstrate responsible practices and provide transparent supply chains. Buyers should focus on sourcing plastics that are recyclable or made from recycled materials, particularly those with the recycling codes 1 (PET), 2 (HDPE), 4 (LDPE), and 5 (PP).

Furthermore, obtaining ‘green’ certifications, such as ISO 14001 or the Forest Stewardship Council (FSC) certification, can enhance a company’s credibility and appeal to eco-conscious consumers. Engaging with suppliers who prioritize sustainable materials not only mitigates environmental risks but also aligns with global trends towards corporate responsibility. As consumers demand more transparency regarding product sourcing, B2B buyers must adapt by investing in materials that are not only safe but also ethically produced.

What Historical Context Should B2B Buyers Consider in the Plastic Bottle Industry?

The evolution of the plastic bottle industry reflects a growing awareness of health and environmental issues. Initially, plastics were favored for their convenience and durability, leading to widespread adoption across various sectors. However, as research unveiled the potential health risks associated with certain plastics, particularly those marked with numbers 3 (PVC), 6 (PS), and 7 (mixed), the industry began to shift towards safer alternatives.

This historical context is crucial for B2B buyers, as it underscores the importance of understanding the implications of the materials they choose. The transition towards safer plastics has not only influenced consumer preferences but has also prompted regulatory changes aimed at reducing harmful substances in packaging. Buyers should leverage this knowledge to make informed sourcing decisions that align with both current market trends and future regulatory landscapes.

In conclusion, navigating the complexities of plastic bottle sourcing requires a comprehensive understanding of market dynamics, sustainability practices, and historical context. By prioritizing safe materials and ethical sourcing, B2B buyers can position themselves competitively in a market increasingly driven by consumer health and environmental consciousness.

Frequently Asked Questions (FAQs) for B2B Buyers of plastic bottle numbers to avoid

-

How do I identify safe plastic bottles for food and beverage use?

To identify safe plastic bottles, look for the recycling symbols on the bottom, which include numbers 1, 2, 4, and 5. These plastics—Polyethylene Terephthalate (PET), High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), and Polypropylene (PP)—are generally considered safe for food storage. Avoid bottles marked with numbers 3 (PVC), 6 (Polystyrene), and 7 (other), as they may leach harmful chemicals into food and beverages. Always prioritize suppliers who provide detailed information about the materials used in their products. -

What are the health risks associated with specific plastic bottle numbers?

Plastics labeled with numbers 3, 6, and 7 pose potential health risks. PVC (3) can release toxic chemicals when heated, while Polystyrene (6) is associated with respiratory and gastrointestinal issues. Number 7 plastics, which include various types, may contain Bisphenol A (BPA), an endocrine disruptor. As a B2B buyer, it’s crucial to ensure that your suppliers adhere to health and safety standards to mitigate these risks in your product offerings. -

What minimum order quantities (MOQs) should I expect from suppliers of safe plastic bottles?

MOQs for plastic bottles can vary widely depending on the supplier and customization requirements. Generally, expect MOQs to range from 1,000 to 10,000 units for standard designs. Customization or specific material requests may lead to higher MOQs. When negotiating with suppliers, clarify your needs and assess their flexibility to accommodate smaller orders, especially if you’re testing new products in your market. -

How do I vet suppliers for quality and safety compliance in plastic bottles?

To vet suppliers, start by checking for certifications such as ISO 9001 for quality management and FDA approval for food safety. Request samples to assess the material quality and gauge compliance with international safety standards. Additionally, consider visiting the supplier’s facility if possible, or use third-party inspection services to ensure they meet your quality expectations before placing significant orders. -

What payment terms are typically offered by suppliers of plastic bottles?

Payment terms can vary, but many suppliers offer options like 30% upfront and 70% before shipping. Some may accept letters of credit or PayPal for smaller orders. It’s essential to negotiate terms that align with your cash flow needs while ensuring protection against potential risks. Always review the supplier’s payment policies and consider escrow services for larger transactions to safeguard your investment. -

What logistics considerations should I keep in mind when sourcing plastic bottles internationally?

When sourcing internationally, consider shipping costs, lead times, and customs duties that can significantly affect your total expenses. Choose suppliers who have experience with international shipping and can provide reliable logistics support. Additionally, factor in the possibility of delays at customs and the need for proper documentation to ensure smooth delivery. Collaborating with freight forwarders can streamline the shipping process and help you manage these logistics effectively. -

Can I customize plastic bottles to fit my brand requirements?

Yes, many suppliers offer customization options such as size, color, and labeling to align with your brand requirements. When discussing customization, provide detailed specifications and inquire about the minimum order quantities for custom designs. Be mindful that customizations may impact production timelines and costs, so ensure these factors are considered during your negotiations with suppliers. -

What should I do if I receive a shipment of plastic bottles that do not meet quality standards?

If you receive substandard products, document the issues with photographs and detailed descriptions. Contact the supplier immediately to discuss the discrepancies and request corrective action, which may include a refund, replacement, or discount. Familiarize yourself with the supplier’s return policy prior to placing orders, and consider including quality assurance clauses in your contracts to protect against such issues in the future.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Top 6 Plastic Bottle Numbers To Avoid Manufacturers & Suppliers List

1. Healthline – Understanding Plastic Container Recycling

Domain: healthline.com

Registered: 2004 (21 years)

Introduction: The article discusses the numbers on plastic containers, which indicate the type of plastic and its recyclability. It categorizes plastics from 1 to 7, detailing their common uses and safety for food storage. Plastics labeled 1 (PET), 2 (HDPE), 4 (LDPE), and 5 (PP) are generally safe for food, while 3 (PVC), 6 (PS), and 7 (mixed) should be used minimally due to potential health risks. The article …

2. Singing River – PET Plastic Insights

Domain: singing-river.com

Registered: 2011 (14 years)

Introduction: #1 PET plastics: Water bottles, juice bottles, some food containers. Made from gas from fracking, contains chemicals and microplastics. Leaching worsens with time, heat, and pH. Avoid if possible.

#2, #4, #5 plastics: Not bad in terms of leaching chemicals but cause environmental issues, especially #5 (bottle caps).

#3 PVC (polyvinyl chloride): Used in pipes, raincoats, shower curtains. Contains…

3. Times of India – Plastic Recycling Codes

Domain: timesofindia.indiatimes.com

Registered: 1996 (29 years)

Introduction: 1. Code 1 (PET or PETE): Products include polyester fabric, water bottles, beer bottles, juice containers, microwaveable meal trays, and detergent containers. Harms: Leaches antimony trioxide and phthalates, linked to cancer and endocrine disruption.

2. Code 2 (HDPE): Products include opaque containers for milk, juice, water, some medicine bottles, and shampoo bottles. Harms: Can leach nonylpheno…

4. Eartheasy – Plastics by the Numbers

Domain: learn.eartheasy.com

Registered: 1999 (26 years)

Introduction: The article “Plastics by the Numbers” provides an overview of the seven standard classifications for plastics, detailing their properties, recyclability, and safety.

1. **#1 – PET (Polyethylene Terephthalate)**: Commonly used in water and pop bottles; intended for single use; recyclable but not reusable; about 25% recycled in the US; can leach carcinogens.

2. **#2 – HDPE (High-Density Polyethy…

5. Sally’s Organics – Safe Plastic Guide

Domain: sallysorganics.com

Registered: 2014 (11 years)

Introduction: Safer plastic codes: 1 (PET), 2 (HDPE), 4 (LDPE), 5 (PP); Avoid codes: 3 (PVC), 6 (PS), 7 (Miscellaneous). Code 1: PET – safe for one-time use, recyclable into fabrics; Code 2: HDPE – thick, opaque, recycle after limited use; Code 3: PVC – toxic, avoid; Code 4: LDPE – flexible, safer, switch to reusable bags; Code 5: PP – relatively safe, recycle; Code 6: PS – leaches styrene, avoid; Code 7 – ofte…

6. Evidence-Based Mommy – Safe vs. Unsafe Plastic Numbers

Domain: evidence-basedmommy.com

Registered: 2018 (7 years)

Introduction: The article discusses safe and unsafe plastic numbers, specifically focusing on recycling codes. Safe plastic numbers include: 1 (Polyethylene Terephthalate – PET), 2 (High-Density Polyethylene – HDPE), 4 (Low-Density Polyethylene – LDPE), and 5 (Polypropylene). Unsafe plastic numbers to avoid are 3 (Polyvinyl Chloride – PVC), 6 (Polystyrene – PS), and 7 (All others, including polycarbonate). The …

Strategic Sourcing Conclusion and Outlook for plastic bottle numbers to avoid

In navigating the complexities of sourcing plastic bottles, it is crucial for B2B buyers to prioritize health and safety alongside sustainability. The numbers on plastic bottles serve as essential indicators, with types 1 (PET), 2 (HDPE), 4 (LDPE), and 5 (PP) being deemed safe for food contact. Conversely, types 3 (PVC), 6 (PS), and 7 (mixed) should be avoided due to potential health risks and environmental concerns.

Strategic sourcing not only mitigates health hazards but also aligns with global sustainability initiatives, particularly relevant for markets in Africa, South America, the Middle East, and Europe. By consciously selecting safe plastic options, businesses can enhance their product offerings while contributing to a healthier ecosystem.

As we look to the future, the demand for safe and sustainable packaging solutions will only grow. International buyers are encouraged to collaborate with suppliers who prioritize transparency and quality in their plastic sourcing practices. Taking action now will not only safeguard your business reputation but also foster a sustainable future. Engage in proactive sourcing strategies that emphasize safety and environmental responsibility, ensuring you stay ahead in a competitive marketplace.